It is a preventive measure and helps you represent your financial records accurately. An allowance for doubtful accounts is considered a “contra asset,” because it reduces the amount of an asset, in this case the accounts receivable. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers. Eventually, if the money remains unpaid, it will become classified as “bad debt”. This means the company has reached a point where it considers the money to be permanently unrecoverable, and must now account for the loss. However, without doubtful accounts having first accounted for this potential loss on the balance sheet, a bad debt amount could have come as a surprise to a company’s management.

Balance Sheet Aging of Receivables Method for Calculating Bad Debt Expenses

This ensures that the company’s financial statement accurately reflects its overall financial health. The estimated bad debt percentage is then applied to the accounts receivable balance at a specific time point. Basically, your bad debt is the money you thought you would receive but didn’t. Doubtful accounts represent the amount of is allowance for doubtful accounts a permanent account money deemed to be uncollectible by a vendor. Adding an allowance for doubtful accounts to a company’s balance sheet is particularly important because it allows a company’s management to get a more accurate picture of its total assets. The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400.

Adjusting entry for bad debts expense

As a general rule, the longer a bill goes uncollected past its due date, the less likely it is to be paid. Companies have been known to fraudulently alter their financial results by manipulating the size of this allowance. Auditors look for this issue by comparing the size of the allowance to gross sales over a period of time, to see if there are any major changes in the proportion. An accounting principle that requires expenses to be matched with the revenues they help to generate in the same period.

Balance Sheet Method for Calculating Bad Debt Expenses

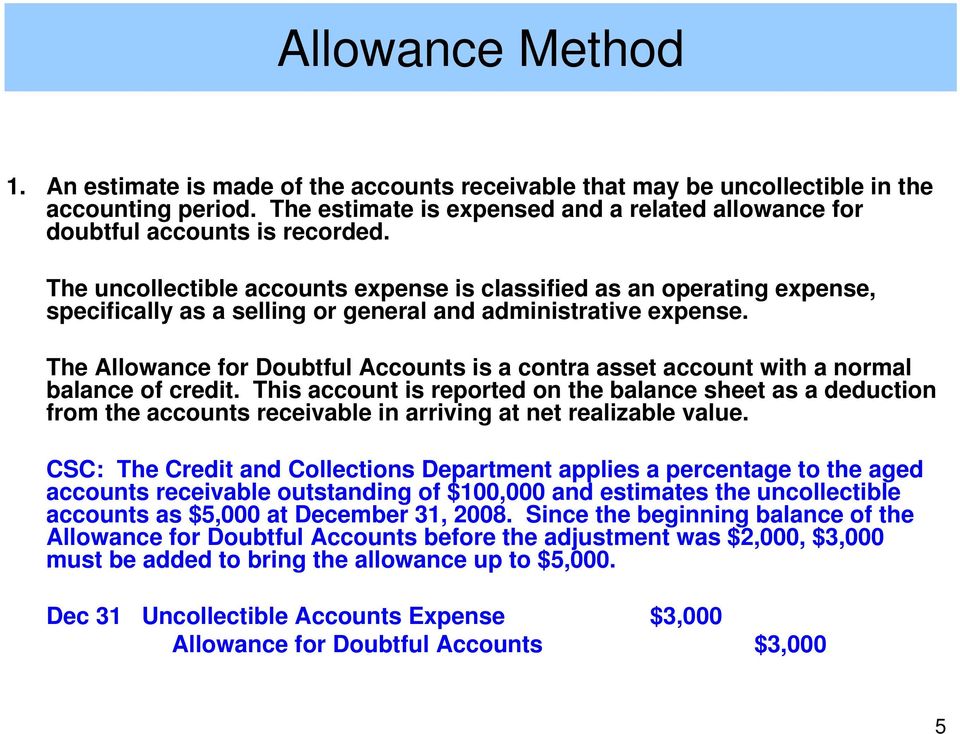

The allowance for bad debt always reflects the current balance of loans that are expected to default, and the balance is adjusted over time to show that balance. Suppose that a lender estimates $2 million of the loan balance is at risk of default, and the allowance account already has a $1 million balance. Then, the adjusting entry to bad debt expense and the increase to the allowance account is an additional $1 million. According to generally accepted accounting principles (GAAP), the main requirement for an allowance for bad debt is that it accurately reflects the firm’s collections history. If $2,100 out of $100,000 in credit sales did not pay last year, then 2.1% is a suitable sales method estimate of the allowance for bad debt this year. This estimation process is easy when the firm has been operating for a few years.

Income Statement Effects

- However, the company is owed $90,000 and will still try to collect the entire $90,000 and not just the $85,200.

- After an amount is considered not collectible, the amount can be recorded as a write-off.

- In this case, our jewelry store would use its judgment to assess which accounts might go uncollected.

- It’s important to note that an allowance for doubtful accounts is simply an informed guess, and your customers’ payment behaviors may not align.

Because it gives you a more realistic picture of the money, you can expect to collect from your customers. While the allowance for doubtful accounts is a useful accounting method that can help assess the true value of the accounts receivable asset, it has shortfalls that need to be considered. It is impossible to know which customers will default in a given year, which makes the process inherently inaccurate. If a large customer defaults unexpectedly, the allowance for doubtful accounts will not protect a company from suffering significant impacts to cash flow and profitability.

AccountingTools

On the income statement, the provision for doubtful accounts is recorded as an expense, reducing the net income for the period. This expense, often termed bad debt expense, directly impacts the profitability of the company. By recognizing this potential loss early, businesses can better manage their financial expectations and make more informed decisions regarding credit policies and customer relationships.

This amount allows your organization to plan for uncollectible debts that impact your bottom line and budget. The final point relates to companies with very little exposure to the possibility of bad debts, typically, entities that rarely offer credit to its customers. Assuming that credit is not a significant component of its sales, these sellers can also use the direct write-off method. The companies that qualify for this exemption, however, are typically small and not major participants in the credit market. The only impact that the allowance for doubtful accounts has on the income statement is the initial charge to bad debt expense when the allowance is initially funded. Any subsequent write-offs of accounts receivable against the allowance for doubtful accounts only impact the balance sheet.

The estimation is typically based on credit sales only, not total sales (which include cash sales). In this example, assume that any credit card sales that are uncollectible are the responsibility of the credit card company. It may be obvious intuitively, but, by definition, a cash sale cannot become a bad debt, assuming that the cash payment did not entail counterfeit currency. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. The method looks at the balance of accounts receivable at the end of the period and assumes that a certain amount will not be collected.

The customer has $5,000 in unpaid invoices, so its allowance for doubtful accounts is $500, or $5,000 x 10%. The allowance for doubtful accounts significantly impacts a company’s financial statements, particularly the balance sheet and income statement. An allowance for doubtful accounts (uncollectible accounts) represents a company’s proactive prediction of the percentage of outstanding accounts receivable that they anticipate might not be recoverable. In simpler terms, it’s the money they think they won’t be able to collect from some customers. The sales method estimates the bad debt allowance as a percentage of credit sales as they occur.

If you use the accrual basis of accounting, you will record doubtful accounts in the same accounting period as the original credit sale. This will help present a more realistic picture of the accounts receivable amounts you expect to collect, versus what goes under the allowance for doubtful accounts. Continuing our examination of the balance sheet method, assume that BWW’s end-of-year accounts receivable balance totaled $324,850. This entry assumes a zero balance in Allowance for Doubtful Accounts from the prior period. BWW estimates 15% of its overall accounts receivable will result in bad debt. By examining past payment trends, companies can determine a reliable percentage of accounts receivable that may become bad debts.